CHANTILLY, France, July 18, 2019 (BSS/AFP) – France on Wednesday said it

would push ahead with its law to tax tech giants that has sparked a row with

the United States, saying that an international accord was the only way to

solve the dispute.

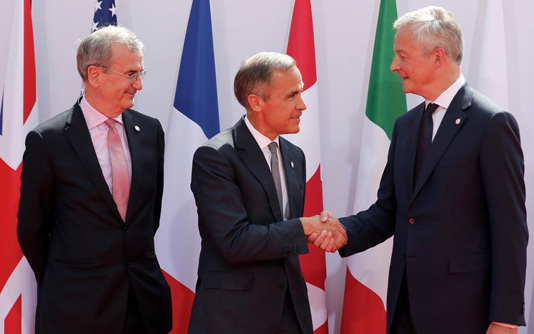

French Finance Minister Bruno Le Maire met US Treasury Secretary Steven

Mnuchin on the sidelines of the meeting of finance ministers from the world’s

seven most developed economies in Chantilly outside Paris.

“We don’t always agree on all issues, but we do agree on many and it’s

always important to listen to each other,” Le Maire tweeted.

The French parliament earlier this month passed a new law that will tax

digital giants on revenue accrued inside the country, even if their European

headquarters are elsewhere, in a move that will affect huge US groups Google,

Apple, Facebook and Amazon.

The move has infuriated President Donald Trump and the US has announced an

unprecedented probe against France which could trigger the imposition of

tariffs.

– ‘Won’t back down’ –

In comments to France Inter radio, Le Maire said France would not back

down on its plans to impose the three-percent tax on revenue.

He said he would make clear that the French parliament had agreed the tax

and this could only be withdrawn if there was an international agreement.

“The possibility of US sanctions against France exists,” Le Maire said.

“There is a legal instrument for that and clearly there is the political

will.”

Even before the final vote by French lawmakers, the US announced it was

opening a so-called Section 301 investigation into the measure.

A Section 301 investigation was used by the Trump administration to

justify its tariffs on China.

But Le Maire said: “France will not back down on the introduction of its

national tax. It was decided upon, it was voted upon, it will be applied from

2019.”

The minister had late Tuesday expressed confidence that the G7 could find

a consensus for an international accord which would be overseen by the

Organisation for Economic Cooperation and Development (OECD).

“This would be the best way to solve this problem,” said Le Maire.

France became the first major economy to pass such tax legislation last

week when parliament gave its final approval.

Britain unveiled legislation last week and Spain’s new government is

expected to introduce its own version.

But smaller EU states such as Ireland and Luxemburg — low-tax countries

which host the European headquarters of the digital giants — have prevented

a consensus in the EU.

While the measure does not specifically target US internet giants, the

French commonly call it the GAFA tax, an acronym for Google, Apple, Facebook

and Amazon.

Work has been under way for several years on a reform of the international

tax system to ensure that multinationals are not able to escape paying taxes

in countries where they do large amounts of their business.

German Finance Minister Olaf Scholz said he hoped that next year there

could be international rules in place that “we can introduce everywhere,

including in the EU and Germany.”

– ‘Serious concerns on Libra’ –

Plans by Facebook to launch a virtual currency called Libra have also

stoked concerns among regulators in numerous countries about regulation and

market oversight of cryptocurrencies.

Le Maire said the conditions were not yet in place to launch Libra, a

virtual currency to be backed with a basket of real-world currencies that

Facebook says will facilitate online financial transactions.

After the first day of meetings, a French official said there was a

“shared consensus” at the G7 about the need for action on Libra.

“Concerns (were) expressed by all the participants about the current

situation and the need to act quickly,” the official added.

Scholz said the ministers and central bankers present had “serious

concerns” about the implications.

“We are talking about currency stability, security, data protection and

democratic control,” he added.

The ministers are also expected to discuss who will take over at the

International Monetary Fund after Frenchwoman Christine Lagarde was named to

head the European Central Bank. The IMF post has traditionally been held by a

European.